Trying to get a mortgage are going to be just as overwhelming because it is actually enjoyable. Between the documentation and you will meetings, you have got most likely stumble on words both familiar and international.

Knowing the loan process is extremely important to make a sound monetary decision – and it every begins with gaining a master of a house language. The newest words guarantee and you can home loan are often made use of near to each other in the path to homeownership, however, gripping its differences is key so you can finding out how lenders view loan applications.

Let me reveal everything you need to realize about security and you can mortgage, out of how they differ and eventually interact included in the mortgage process.

Guarantee vs. home loan

Equity and home loan, when you are found in similar perspective, aren’t compatible terms and conditions. Predicated on Experian, on the most rudimentary words, security is actually a secured item. To possess highest funds, loan providers need some form of a back-up in the event the fresh new borrower is unable to create an installment or entirely non-payments. Should Bessemer loans your borrower gets incapable of and also make payments, the lender is also seize the fresh new security to make up due to their monetary loss.

A mortgage, at exactly the same time, are that loan certain in order to houses where in actuality the a residential property try the brand new security. When you take out a mortgage, if it is of a commercial lender or personal lender, taking care of they’ll constantly wish to know the value of our home you are to shop for (the fresh new guarantee). This helps him or her know if their money is just too high-risk. Extremely scarcely usually a loan provider agree a mortgage bigger than the fresh new worth of the newest guarantee.

Equity is one extremely important little bit of just what loan providers was in search of when evaluating the possibility of home financing – and ultimately if they plan to accept or reject financing application.

How do lenders dictate equity?

When you find yourself loan providers focus on credit, they are often maybe not the brand new power with the home prices. To determine the real monetary value of one’s collateral to possess good mortgage, very loan providers will trust an expert appraiser, according to Investopedia. These home professionals should be able to look at lots away from products about the possessions to decide its worth.

While in the a normal appraisal, a real estate agent will take an independent comparison shop the newest house. They’re going to check always well-known issue such as the floor package, devices and square footage on the top quality and you may graphic. They are going to including look at economy styles as well as the style and you can prices away from comparable home in the neighborhood to help you imagine exactly how much it could be sold having in the industry. They’re going to solution its assessment on to the loan providers to greatly help them make their decision.

Some loan providers might would like to know how much cash properties is attempting to sell to possess regarding the local area and additionally current taxation assessments discover a complete image of the property worthy of.

The three C’s from a mortgage application

Without a doubt, collateral is only one element of a home loan. When you’re lenders may wish to be aware of the property value the home you might be to buy, there are many more situations they’re going to take into consideration when determining whom so you’re able to give so you’re able to.

Worldwide Money Group has made mortgages as facile as it is possible, and you may section of which is providing individuals know what loan providers are interested in. When applying for home financing, recall the step 3 C’s:

Credit – Your credit score is simply the first thing loan providers will evaluate when choosing the qualifications for a financial loan. It does color a picture of their early in the day borrowing and you will payment decisions to help loan providers recognize how you manage obligations of course you are a reputable borrower.

Capacity – Your capacity is the capability to help make your month-to-month mortgage payments. Lenders will appear on several trick factors – just like your financial obligation-to-money proportion – to calculate accurately this element. They will certainly also want to be sure you have got a constant money.

How collateral suits in our Multiple C Ensure

Clearly, guarantee was a major element of a mortgage, however, is not necessarily the merely grounds loan providers find whenever reviewing a great application for the loan.

We intimate rapidly as well as on day given that the process is different than very loan providers, meaning shorter surprises. While most lenders take over 1 month or offered to shut, we could get to the same in as little as 14 days. That’s because we all know the borrowed funds process inside-out and show all of our degree with borrowers so that they can to set up for the mortgage even before it pertain.

We provide numerous imaginative products, fuel by state-of-the-art technology. It will help us view industry styles and acquire the borrowed funds words which can be really advantageous for everyone on it.

I have loan providers all around the nation who are specialists in nearby industry. They come to fulfill however and you will irrespective of where are most convenient to you personally – whether it be owing to current email address, for the mobile phone or even your neighborhood cafe. They’re able to answer your issues and you can take you step-by-step through the loan processes which means you has actually a dependable buddy along the way, just a loan officer.

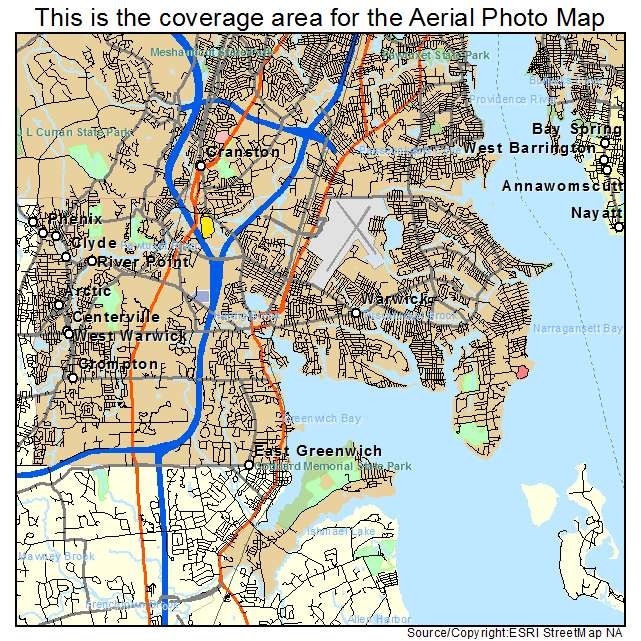

Considering your local area allows loan providers to get attuned to the present state of one’s business and you may local areas of expertise. This will make knowing the equity part of the loan best getting anyone inside it.

Get it Mortgage brokers is quick, painless and easy

If you have receive a property you adore otherwise try not as much as an excellent day crisis, consider finding your upcoming mortgage which have Own it Mortgage brokers. I pride ourselves on all of our Multiple C Make certain in order to streamline the fresh mortgage procedure as well as have you moved within the rapidly.

Our local loan providers are experts in your specific business and are generally only a phone call otherwise current email address off to answer any and all inquiries you really have. To buy an alternate home does not need to getting overwhelming to the proper help. Contact us today to discover more about the lending processes and you will get started on and then make having your house a real possibility.